Black Friday 2024 will see early promotions and a surge in e-commerce, driven by changing consumer behaviors and a focus on personalized shopping experiences.

SAN FRANCISCO, CA, UNITED STATES, September 20, 2024 /EINPresswire.com/ — As Black Friday 2024 approaches, the retail industry braces for a transformative season. HotDeals, a platform revolutionizing online couponing, explores four key trends shaping this year’s event: early shopping promotions, expanding e-commerce, changing consumer preferences, and evolving discount strategies.

Key Trends for Black Friday 2024

1. Early Shopping Season

Retailers are set to begin Black Friday sales earlier in 2024, with many starting promotions in September 2023. This trend will likely continue, driven by a shorter holiday season of just 27 days between Thanksgiving and Christmas (Fox Ecommerce).

1.1 Several factors contribute to the growing trend of early Black Friday shopping:

1.1.1 Consumer Convenience:

Shoppers are opting for early purchases to avoid the stress of last-minute holiday shopping.

1.1.2 Strategic Budgeting:

Many consumers are spreading their holiday budgets over a longer period, taking advantage of various promotions without financial strain.

1.1.3 Retailer Strategies:

Retailers are responding with early promotions and exclusive deals to encourage early shopping and create urgency.

1.1.4 Technological Advancements:

The rise of mobile apps and seamless online shopping makes it easier for consumers to shop anytime, driving the trend toward early purchasing.

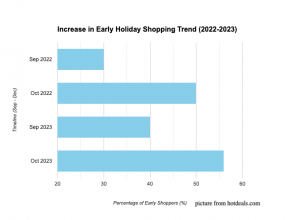

1.2. Key Data Points

1.2.1 Increased Early Shopping Participation:

In 2023, approximately 54% of shoppers began their Black Friday shopping at least 7 days before the event, indicating a clear shift towards early purchasing behavior (WiseNotify).

A Gallup survey found that 25% of holiday shoppers started their shopping as early as September (Experian).

1.2.2 Impact on Sales:

Black Friday 2023 saw a record 200.4 million shoppers participating in Black Friday and Cyber Monday sales, with a significant portion of these shoppers engaging in early promotions (Tidio).

Online sales during Black Friday 2023 reached $16.4 billion, with many consumers taking advantage of deals offered well before the official Black Friday date (Capital One Shopping).

1.2.3 Mobile Shopping Growth:

Mobile devices accounted for over 79% of e-commerce traffic during Cyber Week 2023, highlighting the importance of mobile optimization for retailers (Tidio).

More than 50% of all Black Friday sales in 2023 were completed via smartphones, reflecting a growing trend towards mobile shopping (Experian).

2. Growth in E-commerce Sales

E-commerce sales during Black Friday are increasingly defining the shopping landscape as consumer behaviors evolve. Here’s an analysis of trends and data highlighting the growing dominance of online shopping during this key retail event.

2.1 E-commerce Growth Data

2.1.1 Record Online Sales:

In 2023, U.S. online sales on Black Friday reached $16.4 billion, a 9% increase from the previous year, highlighting the shift towards digital shopping (Storyly; ShopBin).

2.1.2 Global Impact:

Global online sales for Black Friday in 2023 were approximately $70.9 billion, reflecting increasing digital engagement worldwide (Storyly; ShopBin).

2.1.3 Projected Growth for 2024:

Analysts predict a 5% year-over-year increase in U.S. retail sales on Black Friday 2024, potentially reaching $278.645 billion for November, driven by consumer demand and innovative strategies (Storyly; ShopBin).

2.2 Influencing Factors

2.2.1 Early Shopping Trends:

Early holiday shopping is rising, with consumers making purchases before Black Friday, a trend expected to boost online sales into 2024 (Digitorm; Hollywood Gazette).

2.2.2 Mobile Commerce Dominance:

Mobile devices accounted for 79% of Cyber Week traffic in 2023, emphasizing the need for retailers to optimize for mobile users (Digitorm; Storyly).

2.2.3 Personalization and AI:

Retailers are using AI and data analytics to create personalized shopping experiences that impact consumer behavior. In 2023, many holiday sales were driven by personalized marketing, showing that tailored promotions enhance engagement and conversion rates.

3. Consumer Preferences and Behavior

In Black Friday 2024, consumers are more selective and strategic, focusing on quality, seeking personalized deals, prioritizing sustainability, and planning purchases in advance using online research.

3.1 Consumer Preferences and Behavior Data

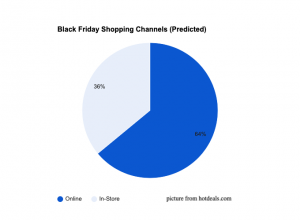

3.1.1 Increased Online Shopping Intentions:

64% of consumers plan to shop online, reflecting the growing preference for e-commerce. Over 90 million people shopped online during Black Friday 2023.

3.1.2 Cultural Significance of Shopping Events:

87% of shoppers are expected to participate in Black Friday and Cyber Monday, highlighting their cultural importance and the social aspect of holiday shopping.

3.1.3 Consumer Spending Plans:

According to a Deloitte survey, consumers plan to spend an average of $567, a 13% increase from last year, showing a willingness to invest in holiday shopping despite economic pressures.

3.1.4 Focus on Discounts and Personalization:

Many seek personalized offers, with over 45% shopping for items they’ve been eyeing, indicating a more thoughtful approach.

3.1.5 Early Shopping Behavior:

Consumers are increasingly shopping early to take advantage of promotions and avoid the rush on traditional Black Friday.

4. Discount Trends

As Black Friday approaches, discount trends are a key factor in shaping consumer behavior and retailer strategies.

4.1 Average Discounts

In 2023, the average discount on Black Friday was around 31%, indicating that retailers are offering substantial savings to attract shoppers.

Early shoppers often benefited from exclusive early-bird discounts offered by retailers, with some deals starting as early as September (Voronoi App).

4.2 Category-Specific Discounts

Certain product categories saw particularly significant discounts in 2023:

– Toys: Toys saw an average discount of 33.4% in 2022, making them an attractive option for budget-conscious shoppers (Voronoi App).

– Electronics: Electronics also featured heavily in Black Friday discounts, with retailers offering deep cuts to entice consumers (Voronoi App).

– Apparel: Clothing retailers like JCPenney and Macy’s topped the list of average discounts in 2023, offering 59% and 58% off, respectively (Visual Capitalist).

4.3 Consumer Response

Consumers are responding positively to discount trends for Black Friday 2024:

– Increased Spending: Shoppers plan to spend an average of $567 from Black Friday to Cyber Monday, a 13% increase from 2022 (CBS News).

– Online Shopping Growth: Online purchases are expected to average $169 this Black Friday, a 40% increase from 2019 (CBS News).

Conclusion

As Black Friday 2024 approaches, the retail landscape is changing with early shopping trends and e-commerce growth. Retailers are launching early promotions and optimizing for mobile, enhancing convenience and personalization for a busy holiday season.

Jimmy Zhao

HotDeals Science LLC

[email protected]

Visit us on social media:

Facebook

X

LinkedIn

Instagram

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()

Originally published at https://www.einpresswire.com/article/745083377/black-friday-2024-early-promotions-e-commerce-surge-and-shifting-consumer-trends-set-to-transform-holiday-shopping